Simplifying Broker Workflow

for Comparing Cyber

Insurance Quotes on Finlex

Simplifying Broker Workflow

for Comparing Cyber

Insurance Quotes on Finlex

This project aimed to improve the user experience for brokers comparing cyber insurance quotes on behalf of their clients. The primary goal was to streamline the process of comparing quotes from multiple insurers and make it easier for brokers to understand the underwriting decisions.

This project reinforced the power of design synergy. Combining user research with data analysis allowed us to not only understand broker pain points but also identify specific areas for improvement. This data-driven empathy led to a more efficient and user-friendly quote comparison experience.

Talayeh Dehghani

The client for this project is Finlex, a company that provides a platform for insurance brokers to compare and request quotes for various insurance products, including cyber insurance. Their target users are insurance brokers who utilize Finlex's platform to streamline their workflow and provide efficient service to their clients by comparing coverage options from multiple insurers.

Brokers found it difficult to compare quotes from different insurers because they had to navigate to separate pages for each insurer. Additionally, the current system did not clearly communicate whether a quote was final, required approval, or if the insurer was declining coverage. This lack of clarity made it difficult for brokers to quickly assess their client’s options

Services

Usability Teating

wireframing

Task flow development

To gain a deeper understanding of the user experience and identify specific pain points, I employed data-driven discovery techniques alongside the traditional UX design process. Here's how data informed the design decisions:

User Analytics: Existing user behavior data on the Finlex platform was analyzed to identify patterns in how brokers interacted with the quote comparison feature. This data helped pinpoint areas with high drop-off rates or excessive time spent, suggesting potential usability issues.

Heatmaps and Session Recordings: Heatmaps visualized user clicks and attention patterns on the quote comparison page, revealing which elements were most prominent and which areas might be overlooked. Session recordings captured user interactions and navigation flows, providing valuable insights into user behavior and thought processes.

I created a site map to visualize the platform's information architecture, focusing on key pages relevant to comparing cyber insurance quotes. This provided a clear understanding of the user journey and helped identify potential bottlenecks.

Task flows mapped out the steps brokers take to compare quotes for a client, from logging in to viewing underwriting decisions. This analysis pinpointed specific areas where the process could be optimized.

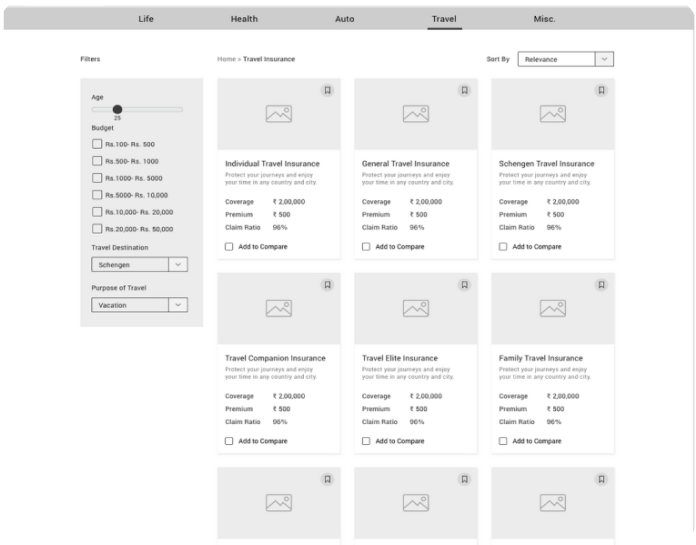

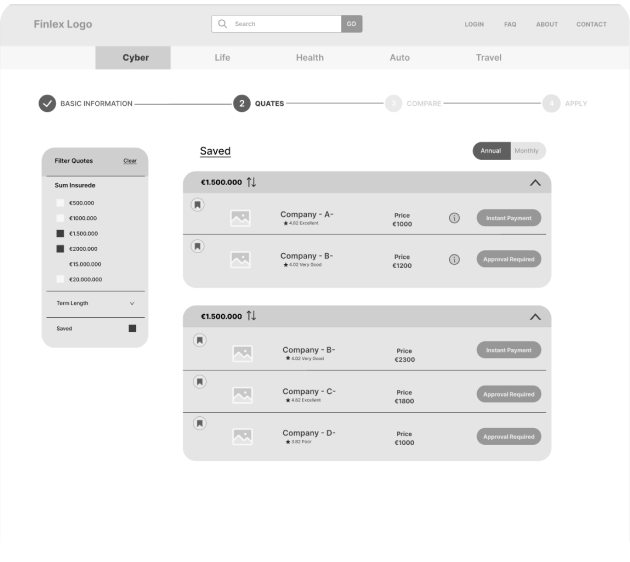

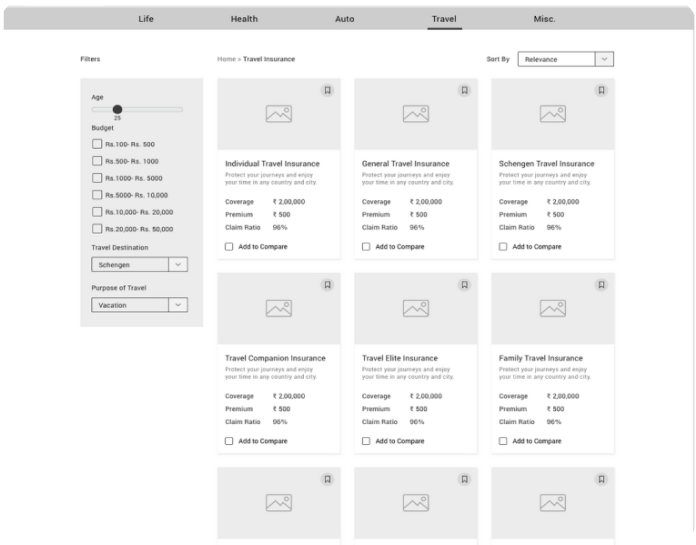

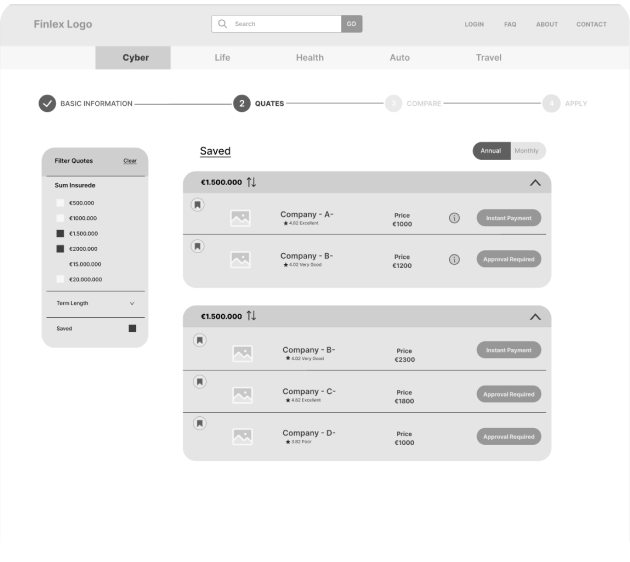

Wireframing: Low-fidelity wireframes were created to establish the initial layout and user interface structure for the quote comparison interface. These wireframes prioritized functionality and content organization over visual design.

Cognitive Walkthrough: Brokers were guided to think aloud while navigating the mid-fidelity prototype. This technique helped me identify any potential usability problems from the user's perspective and understand their thought process as they interacted with the design.

Mid-fidelity Prototype Development: A more refined prototype with visual design elements (fonts, colors, icons) was developed to allow for interactive testing of the proposed solution. This prototype enabled users to experience a closer representation of the final product.

5-Second Testing: Users were shown the prototype for just 5 seconds, then asked to recall key information. This method gauged the clarity of the quote comparison table and ensured critical information was readily available at a glance. Guerilla Testing: Real insurance brokers participated in usability testing sessions, providing valuable feedback on the design's intuitiveness and overall workflow improvements. This real-world testing ensured the design addressed the needs of the target audience.

Based on the valuable insights gathered from the various testing methods, I iteratively refined the design of the quote comparison interface. The following features were implemented:

Consolidated Comparison Table: A dedicated table displays all quotes from different insurers on a single page. This allows for effortless comparison of coverage details, pricing, and underwriting decisions

Underwriting Decision Icons: Visual icons (e.g., approved, pending approval, declined) represent the underwriting decisions for each quote. This provides a quick and clear understanding of the status for brokers

Informative Tooltips: Additional information regarding underwriting decisions is readily available through tooltips. This could explain why a quote might be pending approval, for instance.

During usability testing, the redesigned quote comparison interface received positive feedback from brokers. They found it significantly easier to compare quotes and readily comprehend the underwriting decisions. This translates to an improved workflow for brokers and a more efficient experience for their clients when selecting suitable cyber insurance coverage.

Future iterations will involve Adding the ability to filter and sort quotes by specific criteria, allowing for even more targeted comparisons. Integrating with other systems used by brokers, such as CRM software, to further streamline their workflow.

This project exemplifies how a user-centered design approach, incorporating various research and testing methods, can significantly improve the experience for insurance brokers utilizing Finlex. By providing a clear and efficient comparison interface, brokers are empowered to make informed decisions and deliver exceptional service to their clients.